S. E. Dastur, Sr. Advocate, has written a fascinating autobiographical article in which he has reflected on all the key events of his illustrious career spanning over 60 years, including the fact that the great Nani Palkhivala had “rejected” him as a junior. The initial disappointment turned out to be a blessing in disguise, Mr. Dastur says

AS IT WAS, IS AND MAY BE

(MUSINGS FROM THE PAST, ABOUT THE PRESENT

AND THE FUTURE AS FORESEEN)

SOHRAB ERACH DASTUR

Senior Advocate

As one’s professional career inches to what would be the age of a senior citizen one tends to look more to the past than the future. One suddenly finds that he/she can remember what happened in 1990 more clearly than what happened in 2016!

When the Editor of the 50th anniversary publication of the BCAJ approached me to write an article and suggested that I recollect real life experiences, I expressed serious reservations as to whether anybody would really be interested in the same. I do hope the Editor does not have cause to regret his mistaken choice (of person and subject). In any case, my vanity ultimately prevailed and I agreed to pick up my pen and let it run wild.

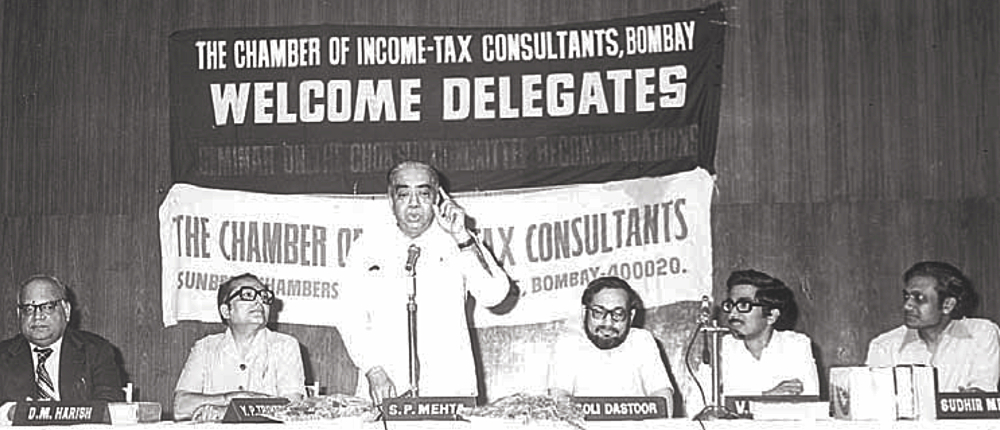

Prof. Sanat P. Mehta’s lectures at Govt Law College were most popular

In 1952, I joined the Sydenham College of Commerce and Economics named after Lord Sydenham, a former Governor of Bombay. At that time, it was situated in premises belonging to the J. J. School of Arts (with two divisions of the first year class being located in the Sukhadwala Building near Excelsior Cinema). My father was in the first batch of students (of 1913) to enroll in the College! My brother as well as my wife graduated from Sydenham. It was, perhaps the only College with a tennis court! In 1955, the College shifted to its present location on B. Road near Churchgate.

In 1956, I joined the Government Law College for the then two-year LL.B. degree course for those who had already graduated. Surprising as it may sound to today’s college student fraternity, at that time at least 90% of the students attended classes regularly (the Canteen residency was limited). For the lectures by Prof. Sanat P. Mehta on the Indian Constitution, the class was always full even though the lectures were scheduled at a most unearthly hour early in the morning. I understand that today the percentage is reversed and perhaps more than 90% do not attend lectures but join private coaching classes. In our days a student who took private tuitions was looked down upon as being backward! What I find even more surprising, and rather intolerable, is that I am told that today professors themselves do not attend regularly. The other leading Counsel in the field of Tax Law at that time were Mr. R. J. Kolah and Mr. N. A. Palkhivala. Mr. R. J. Kolah was also the foremost lawyer in the field of labour law – if this branch did not rub off on me it was, I suppose, because I did not labour enough. Two Solicitors: Mr. N. R. Mulla and Mr. Tricumdas Dwarkadas also had a large practice in the Tribunal. Mr. Tricumdas (partner in the firm of M/s. Kanga & Co.) was and has been the only person allowed to appear before a Bench of the Tribunal, otherwise than in the regulation coat and tie! I may in passing, mention my eternal admiration of Sir Dinshaw Mulla (the founder of the firm of M/s. Mulla and Mulla) for the number of classical treatises he has written on varied legal subjects. I do not think anyone, the world over, has rivaled his achievement.

(Mr. Sanat Mehta addressing the audience while M/s D. M. Harish, S. E. Dastur, V. H. Patil, Sudhir Mehta are on the dais)

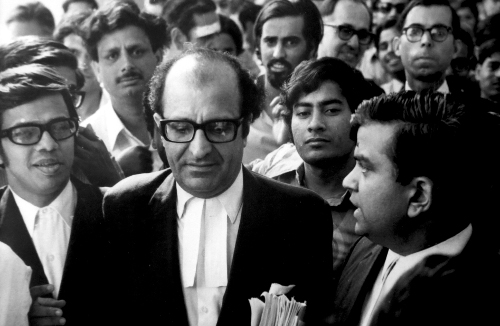

N. A. Palkhivala did not accept me as a Junior!

With the confidence (arrogance) of youth I decided to take the plunge in individual law practice as, according to me, it afforded independence. The next question was whose Chamber I should join. At the request of Mr. R. K. Dalal, the founding partner of the Chartered Accounting firm of Messrs. Dalal & Shah, Mr. N. A. Palkhivala agreed to see me but not to accept me as a Junior! Thereafter, through the good offices of Mr. Maneck P. Mistry (popularly known as “Botty” Mistry, though I do not quite know why) I joined the Chambers of Mr. R. J. Kolah.

(The legendary Nani Palkhivala)

Chambers of R. J. Kolah & other legends

The Law Chambers were at that time just newly located on the first floor of the Annexe building which was connected by a passage to the High Court Building. Chamber No.1 was of Sir Jamshedji B. Kanga in which Seniors of great eminence like Mr. K. H. Bhabha, Mr. Murzban Mistree etc., who were earlier his juniors, functioned. Chamber No. 2 was of Mr. R. J. Kohla and chamber No.3 of Mr. N. A. Palkhivala. Prior thereto Chambers of Counsel were on the Ground Floor of the High Court Building to the left as one entered the High Court building from the gate near the University (and not the one near the Hong Kong Bank building). Later in 1987, Counsel functioning from the Annexe building received notices to quit as the High Court wanted the premises for itself.

The atmosphere on the 1st floor was unique. There was great fellowship between the 50 odd Counsel who occupied the 12 Chambers situated there including the Chambers of Mr. Motilal Setalvad (the first Attorney-General for India), Mr. M.P. Amin (Advocate-General for the State of Bombay) and Mr. Karl Khandalawalla, a lawyer of eminence at the Criminal Bar, and many more. Mr. Khandalawalla was a distinguished art critic. He was as devoted to art as Mr. Kolah was to horse-racing and to dog-racing (which latter sport he wanted to initiate at the Brabourne Stadium). Very often when Mr. Kolah was in the Supreme Court on a Friday but his matter had not concluded, he would fly back to Bombay on Friday night and after attending the races at Mahalaxmi on Sunday evening proceed by the early morning flight on Monday back to Delhi. He travelled extensively for professional work and invariably went to the then Santa Cruz airport by the airport bus run by Indian Airlines. I still remember a delightful photograph which was displayed in Chamber No. 2 of Mr. R. J. Kolah in a top hat and tail coat with his devoted and charming wife Lorna, which photograph was taken when they had attended the Epsom Derby race in England.

First brief

My practice as a lawyer had a slow (more accurately, a very slow and halting) start. In the first year of my practice at the Bar I earned a total of Rs.30 and that too not on account of any merit of mine! A brief for applying for an adjournment at 2.45 p.m. (which was when the High Court used to resume work at that time after the lunch break), was marked by Messrs. Little & Co. (the instructing solicitors) for Mr. K. K. Koticha, Advocate. A fee of 2 Gold Mohurs (GMs) which is the denomination in which advocates practicing on the original side of the High Court traditionally marked (and some still mark) their fees. Interestingly a Gold Mohur, a currency prevailing in ancient times, was reckoned at Rs.15 in Bombay, Rs.16 in Delhi and Rs.17 in Calcutta! The bearer of the brief could not locate Mr. Koticha in the High Court library as, (most fortunately!) he had gone out for lunch. He noticed that (having nothing better to do) I was sitting in the Library and offered the brief to me. This incident increased my belief in a kind, benevolent and benign God who looked after briefless lawyers!

(Mr. Dastur enjoying a light moment with Mr. V. H. Patil. M/s Ashok Kotangale, Atul Jasani and Y. P. Trivedi are in the background)

“Gadhero thai gayoch ke?” (Have you lost your mind?)

I may mention that Mr. Palkhivala had once offered me employment in the legal department of Tatas at what I considered to be a princely salary. My brother, Jal, a Chartered Accountant of great learning, was vehemently against my accepting the offer and when I talked about it to Mr. Kolah he was forthright, as usual, in his view. He remarked “gadhero thai gayoch ke.”

Early days of the ITAT

When I commenced my practice in 1959, the Income-tax Appellate Tribunal (Tribunal) had 2 Benches each in Bombay, Delhi and Calcutta and one at Allahabad, Madras, Patna and Hyderabad. If I remember correctly, there were just 2 or 3 Commissioners of Income-tax in Bombay jurisdiction. I have lost track of the number of Principal Commissioners of Income-tax and Commissioners of Income-tax who now hold office. The Tribunal which was formed in 1941 was initially located in the Industrial Assurance Building near Eros Cinema. By 1959 it had shifted to its present location. I have not been able to discover exactly when such shift was effected. Even the Encyclopaedic Dr. K. Shivaram, has not been able to enlighten me!

The ITAT has evolved into the leading and most satisfactorily of all functioning Tribunals. I may refer to what I consider to be two unfortunate administrative aberrations on its part. The Headquarters of the Tribunal has always been at Bombay. Three Presidents shifted the office of the President to Delhi. Thus, during their tenure, though the Headquarters of the Tribunal was at Bombay, the office of the Head of the Tribunal was in Delhi! A junior lawyer appropriately remarked, “the importance of the Headquarters of the Tribunal has now been reduced to a quarter thereof!” Mr. Rajagopala Rao a very sincere, patient and fair member had during his tenure as President very correctly restored the President’s office to Bombay.

The other unfortunate administrative decision is that the Tribunal now organizes a farewell meeting for a retiring member. The hallowed tradition followed by the Income-tax Tribunal Bar Association, at Bombay, (in the same manner as by the High Court Bar Association) was that it was the prerogative of the Bar to organize a Reference to a retiring member (if the Bar felt he merited one). The occasional decision of not granting a Reference on the retirement of a member (considered by the Bar as not being fit to be so honoured) was not acceptable to the authorities.

There cannot be a truer saying than “Justice delayed is justice denied.” As major reason for the abysmal mounting arrears both in the Tribunal and the Courts is on account of the fact that the judicial authorities have to function much below their sanctioned strength. It is proudly claimed that the present Government is one which works. However, there does not appear to be any evidence in support thereof, at least in the law and judicial field. When a vacancy will occur is known well in advance – the only exception being the unexpected event of resignation or unfortunate premature demise. Instead of spending time on making tax life more complicated, cannot the Ministries of Law and Finance find time to attend to this long-standing yet unresolved problem?

The malaises of mounting arrears of tax appeals and writ petitions in the High Courts would be alleviated if more judicial members of the Tribunal, and perhaps even Accountant Members with appropriate judicial qualifications, were promoted to the High Courts and special benches dealing the year round with tax matters were set up in the High Courts. It may also be appropriate if the Supreme Court collegium, which finally recommends persons for promotion to the High Courts, was a little more circumspect in rejecting proposals for such promotion made by a High Court. It is for serious consideration whether, in the event of there being a doubt about the fitness of a member for promotion to the High Court, it is possible to devise a system whereunder the Collegium obtains (on the condition of maintenance of complete secrecy) the views of Advocates of pre-eminent reputation, who have practiced before the concerned person.

Advocate vs. lawyer

Legal practice can be broadly of 2 types: a) table practice comprising of advisory work in conference, furnishing of written opinions and drafting pleadings and b) arguing matters before different fora. Variety is the spice of life and, as in life generally, it is always good to have a combination of all possibilities. However, if I had to choose only one of the two forms of legal practice I would certainly plump for the second alternative as appearing before a Tribunal or Court requires one to attune one’s arguments to what is likely to appeal to the particular judge, bearing in mind his approach to life, his bent of mind and also brings into focus one’s ability to respond immediately to queries (relevant and irrelevant) His Lordship or Honour may pose. A ready repartee, a light hearted remark sometimes achieves more than learned legal submissions based on case laws. One has also to cultivate the ability to deal on the spot with arguments urged by the opposing Counsel. The ability to do all this is what distinguishes an Advocate from a lawyer. Law can be learnt from text books, – advocacy requires an inherent talent and experience.

The practice of tax laws is not confined just to the provisions of the relevant Direct Tax Acts. One has to consider the provisions of a whole range of what may be termed as “general laws” like the Transfer of Property Act, personal laws which determine succession to a deceased’s property, company and partnership law (including the Limited Liability Partnership Act), stamp duty and registration provisions, and laws relating to limitation and new financial instruments etc. Even the provisions of the Evidence Act and of criminal law may have to be applied. A judge once addressed Counsel arguing a tax appeal before him by saying. “You tax lawyers …” Counsel replied, “I am not aware of any such animal!”

Disappointments in life are all for the good

About 3 or 4 years after I joined the legal profession, Mr. N. A. Palkhivala gradually shifted the field of his operation from Chamber No.3 to his office in Bombay House and became a Director of several Tata companies. It was somewhat of a unique decision because Counsel generally prefer to operate from their own independent chambers without being associated with a particular business house. In retrospect I felt that it was all to the good that he had not approved of me as a prospective junior. Unfortunately, in life when one is faced with a disappointment it is only in retrospect that one thinks of the disappointment as being all for the good.

Overdose of amendments

Lord Macnaghten in London County Council v. Attorney-General 44 TC 265, 293, observed “Income Tax, if I may be pardoned for saying so, is a tax on income. It is not meant to be a tax on anything else.” Our Finance Ministers should take heed of these words of wisdom. Today, section 2(24) of the Income-tax Act includes twenty-eight items as “income,” quite a few of which cannot at all be regarded as “income.” The zeal of our Finance Ministers has resulted in our presently having Volume 402 of the Income-tax Reports. The publication of the Income-tax Report started in 1933. The proliferation of litigation is shown by the fact that whereas till 1950 we had only one volume of the Income-tax Reports per year, now (in 2017) we have 10 Volumes per year and I do not know how many volumes 2018 will generate! Prior to the publication of the Income-tax Reports we had “Income-tax Cases” which covered 10 Volumes relating to the period from 1886 to 1937. The Tax Cases in England published from 1876 presently are in the 80th volume. Of course, in so far as the legal profession is concerned, the Indian overdose is all to the good! I may note in passing something which is rather intriguing. In India we refer to “Income-tax” but in the United Kingdom it is “Income Tax.”

There is today a strong lobby which doubts the wisdom of several provisions in the annual Finance Bills (sometimes 2 per year) which amend the Income-tax Act. The thought process which goes into the enactment of the proposed amendments is best illustrated by the fact that recently the Finance Bill, 2018, was apparently passed by the Lok Sabha without debate.

100% tax rate during socialism regime

Some people today complain about the rates of tax and surcharge making unwarranted inroads into one’s income earnings. They overlook that during our flirtation with socialism some assessees were liable in 1972 to 1973 to pay more than 100% of their income as direct taxes (income-tax plus wealth tax). The imposition of such draconian rates of taxes led to the development of a tax planning industry. Some of the schemes were really fantastic. An assessee is certainly not bound to pay the maximum amount of tax possible. At the same time excessive and daring tax-planning is not advisable as, in my view, a good untroubled night’s sleep is more important than the possible increase in one’s wealth by embarking on such a scheme. I hasten to add that tax planning is undoubtedly legal and permissible. The Duke of Westminster’s case (19 TC 490) is a classic example of tax planning, perhaps even stretching the permitted limits. Nevertheless, the Supreme Court in Union of India v. Azadi Bachao Andolan 263 ITR 706 observed at page 758 that the principle in the Honourable Duke’s case “was very much alive and kicking.” Even ignoring the exceptional 2 years in the 1970s one has ruefully to accept that in several other years in the past the individual income-earning assessee (Mr.A.) was a junior partner in profit sharing in the firm of the Central Government and Mr.A!

There is no reason why we should complain about the present rates of income-tax even though one may not be able to muster the enthusiasm of Justice Holmes of the U.S. Supreme Court who observed “Taxes are what we pay for civilized society. I like to pay taxes, with them I buy civilization.” Mr. C. K. Daphtary, the first Solicitor-General of India, who was known for his ready wit and felicity of language, in a speech when he was felicitated by the Bombay Bar, referred to the observation of Justice Holmes and wryly commented “If by payment of taxes one buys present-day civilization then I do not want any part of it!” The key issue was rightly summarized by Justice Sabyasachi Mukharji in CWT v. Arvind Narottam 173 ITR 479: “Does he with taxes buy civilization or does he facilitate the waste and ostentation of the few. Unless waste and ostentation in Government spending are avoided or eschewed no amount of moral sermons would change people’s attitude to tax avoidance.” Mr. N. A. Palkivala has pithily observed “a widespread taste for tax promises to be a thing of slow growth.”

The prodigious and unwieldy growth of tax legislation and amendments after the present Act came into being is evidenced by the fact that, to cite but one example, between section 115 and section 116, more than 120 sections have been inserted at one time or the other. The total inadequacy of the English language to provide for this overdose is shown by the fact that we have such monstrosities as section 80JJAA and section 115BBDA!

GAAR will lead to prolific litigation

The change in the nature of the litigation then and now is striking. In 1959 a large part of the appeals before the Tribunal centered around cash credits, unexplained investments, capital and revenue expenditure etc. The litigation is now more sophisticated and with an international flavour like the circumstances in which income earned by a non-resident from an asset situated outside India is to be deemed to accrue or arise in India (section 9), transfer pricing and Double Taxation Avoidance Agreements. One of the most often cited cases today is the decision of the Supreme Court in Union of India v. Azadi Bachao Andolan 263 ITR 706 where the Supreme Court laid down the path-breaking interpretation to be placed on the words “may be taxed” appearing in DTAAs. I daresay in the future, a substantial part of the litigation will centre around Chapter XA of the Income-tax Act (concerning General Anti-Avoidance Rule) bearing in mind the very wide, if not wild, provisions which have been enacted.

People often condemn Treaty Shopping overlooking that Treaties are negotiated with several political, economic and other considerations in mind and if in achieving/implementing the same tax concessions are available so be it. If the Government negotiates a treaty which opens a shop it cannot complain if people resort thereto!

Should a High Court judge be President of the ITAT?

A matter of great importance to the well-functioning of the Tribunal is who is appointed as its President. Previously, the Central Government was empowered to appoint the Senior Vice-President or one of the Vice-Presidents to be the President. Now sub-section (3) of section 252 of the Act enables the Central Government to appoint in addition a person who is a sitting or retired judge of a High Court and who has completed not less than seven years of service as a judge in a High Court.

Pursuant to the newly acquired power vested in it in 2013 the Central Government appointed a retired judge of a High Court to be the President of the Tribunal with effect from 14th March, 2015. In my view the conferment on the Central Government of the option to appoint a retired High Court judge as the President is misconceived. The President has to perform various administrative tasks relating to the functioning of the Tribunal such as constitution of the Benches, the posting of members etc. which requires him to be a person who has worked as a member for a long period of time before he assumes charge as President. The President is also a part of the Committee to select persons to function as members of the Tribunal. An existing Vice-President, and more so the Senior Vice-President, would be fully experienced to discharge these functions. A retired High Court Judge is not likely to be aware of the plethora of judgements, reports, magazines etc. dealing with the tax matters. Speaking for myself I do not think the experiment of appointing a retired High Court judge as the President of the Tribunal was at all successful.

Entire income-tax Act should be redrafted and not just piecemeal amendments

For almost two decades moves have now been afoot to redraft our income-tax law. It was way back in 1997 that “A Working Draft of the Income-tax Bill, 1997” saw the light of day. This was followed in August 2009 by the Direct Taxes Code. Later, the Direct Taxes Code Bill 2010 was published. It is undoubtedly necessary to redraft the entire Act and not merely to move piecemeal amendments. However, one has to bear in mind that several critical sections have already been interpreted by the High Courts and the Supreme Court. If in the process of redrafting them, different language is used, even though the same may appear to be more elegant, it may start the ball of fresh litigation rolling once again. This would be not only time but money consuming and cause harassment to the assessee, though of course it may fill the pockets of tax lawyers and practitioners. The net gain may be that the Government would be able to collect more taxes from them!

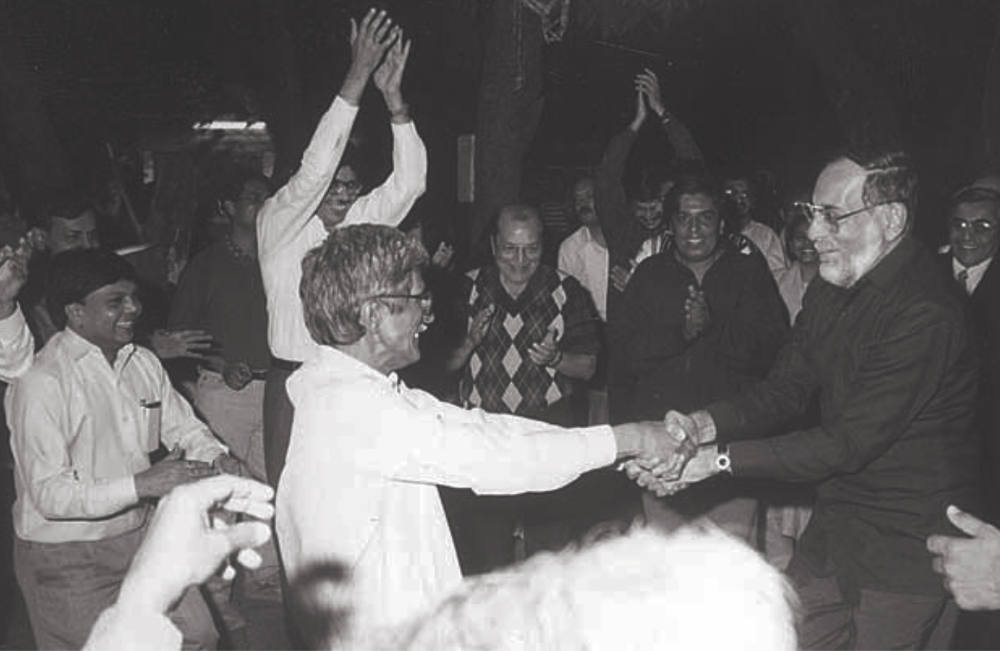

Most satisfying achievement: Chamber of illustrious juniors

A professional in the field of law is often asked which is the moment in his legal practice or which is the case or matter which he has argued or handled which has left him with a sense of enduring satisfaction. For myself I would say that what is most satisfying is to note with admiration how those who have passed through my Chambers have overcome that handicap and achieved enviable eminence in their own legal careers.

(Mr. Dastur with some of his past juniors)

Essentials for success in the legal profession

Another question a lawyer is often asked is what is most essential for success in the legal profession. My answer is simple: the ability to find an all understanding spouse who will (a) put up with ill-temper (which the lawyer can’t afford to exhibit in the Court room or in his Chamber and, consequently, reserves it for the residence) (b) tolerate and overlook his forgetting specific occasions and (c) be immune to his lack of punctuality in attending to and looking after personal and social commitments.

E-Assessment “in purdah”

One gathers from newspaper reports, instructions issued by the CBDT and comments regarding the provisions in the Finance Bill, 2018, that it is proposed to vest more and more powers in the Centralised Processing Centre (CPC) in Bengaluru. Whilst such a move may be theoretically supportable I feel that the Government should first put in place a satisfactory and reliable mechanism to resolve grievances and objections raised by assessees. Let me refer to only one example. Nowadays, if a refund is due to an assessee it is adjusted against what is shown as arrears due from him in the records of the all powerful, all knowing, but “in purdah” CPC. Protests lodged with incontrovertible proof in support, against the proposed adjustments are dealt with by a standard response: “Your objections ‘if any’ have been considered and no interference is called for.” Representations and appeals for justice to the higher authorities have invariably proved futile. The use of the words “if any” shows a complete lack of application of mind (if any exists). Today an assessee can contact his Assessing Officer and personally explain to him that the alleged arrears are not outstanding by producing documents in support of such assertion and by responding to any doubts entertained by the Officer. This avenue is no longer open.

High sounding words and phrases are used to declare what the Government proposes to do. For example, it is stated 1) there would now be team-based assessments with dynamic jurisdiction 2) there would be jurisdiction-free assessment i.e., a tax payer in Delhi could be assessed by a tax officer situated elsewhere in India 3) the role of the tax officials will be split into functions of assessments, verification, tax demands, recovery etc.” What these phrases mean is not at all clear to me and perhaps not even to the tax officers!

The new system is allegedly designed for minimizing the scope for corruption. However, the cure seems to be worse than the disease at least from the point of view of the honest tax payer who will now be denied the opportunity of a direct and fair hearing.

If minimal interaction between the assessee and the tax officials is the goal for allegedly avoiding corruption it would, perhaps, be more meaningful to formulate rules limiting interaction between the citizen and ministers and the citizen and powerful Government Officers as it is these interactions which are probably most corruption prone.

I had better now conclude these ramblings before my pen runs completely dry and before the reader, (if any), of this article wants to turn over the pages to venture to the next article, assuming he has not already entered slumberland.

It is said that what distinguishes a good lawyer from the run-of-the-mill ones is that he can articulate his views precisely and briefly. I have hopelessly failed so to qualify as I have over-stepped the limit suggested by the Editor for the length of this article!

I must record that the Editor had very thoughtfully and helpfully suggested as one of the titles for my proposed article “Happy Hours at the Bar.” I can only say that whilst young there are undoubtedly happy hours at the Law Bar, but as one grows older, one appreciates the happier hours one can spend at a conventional Bar which creates a feeling of solidity,induced by consuming liquidity!

Mr. soli Dastur Article is very inspiring for young students of law

Thought provoking, enjoyable article by Mr. Soli Dastur. I remain his fan and proud to have been his student.

Your article is incomplete without reference to your father Erachsha a great chartered accountant and partner of one of the oldest firm of CAs M/s Sorab S Engieer & co and also great chartered accountant Your Brother Mr. Jal who cannot do any thing wrong in life. For principle he can sacrifice his brief which may be paying of handsome fees. He has also guts to differ from the views of great legend on the matter of company law.

Very interesting article. “Disappointments in life are all for the good”, can boost confidence of many….Flashback from his college days and then travel up to current e-assessments/GAAR era is really rich experience to know , which Shree Dastur Saab has shared with readers through this article.

Excellent remarks and comments and views of Mr. Soli Dastur. I had occassion to meet him a few times and he came through as a remarkable gentleman. There is a lot that younger members of the Tax Bar can learn from him. I wish him a golden period of life ahead and wish him good health and happiness.

I enjoyed nourished and thirlled the following lines in his aritlce

The new system is allegedly designed for minimizing the scope for corruption. However, the cure seems to be worse than the disease at least from the point of view of the honest tax payer who will now be denied the opportunity of a direct and fair hearing.

If minimal interaction between the assessee and the tax officials is the goal for allegedly avoiding corruption it would, perhaps, be more meaningful to formulate rules limiting interaction between the citizen and ministers and the citizen and powerful Government Officers as it is these interactions which are probably most corruption prone.

and overdose of amendments”

Humble, modest, inspirational and motivational. Thanks for the guideline to the young professionals.

Also Thanks for publisher for article.

With due reverence to the renowned lawyer’s – perhaps the very few left in the top rank- forthright and frank exposition of the to-days TAX REGIME:

To share a few quick thoughts, selectively:

“Overdose of amendments”

…..

•personally been left wondering, wildly so : should due regard be had to the pith and substance of what he says, that might have to be more appropriately termed as a ‘lethal dose of’; in the result,putting both tax- lawyers and – payers in a state of coma, waiting to be wheeled into a ICU ?!

“GAAR will lead to prolific litigation”

“…….where the Supreme Court laid down the path-breaking interpretation to be placed on the words “may be taxed” appearing in DTAAs.”

•It is noteworthy that, among others, –

in sec 95(1), in the very opening sentence, likewise, the operative words significantly used are “may be declared” to be an ‘impermissible avoidance arrangement..’

(May have more to share!)

Honestly, sincerely and nicely crafted Diamonds.

An Update (on the related / linked (to “GAAR”)- aspect of ‘indirect transfer’: https://www.facebook.com/swaminathanv3/posts/1671661092910170

We had the privilege to introduce Soli.J Dastur into the portals of Allhabad High court(and then the ITAT Allhabad too ) for the very first time. And significantly Sir Dastur enjoyed it. And we as the star struck junior counsels to assist in whatever little ways in the late late nigh preparations felt as if some momentous assignments were delegated on to us. His very presence was a contagion for proactive. And then his court craft the subtle turn of phrase, pricks and duels in the courtrooms ever so felicitously conducted.It was always a grand drama and education-in-law tour de force.

If closely te(a?)sted GAAR, -G for general- is a ‘kichadi’ cooked by the North Block,in a tearing hurry,with ‘indirect transfer’ and ‘transfer pricing’ as the unsavory ingredients, of sorts!

For an insight . may, if so mind and care to,have a peep through – https://www.facebook.com/swaminathanv3/posts/1672582829484663

Apropos of the last Post of May 16, an attempt has since been made to Update, with added input / a dilation of some of the clinching aspects of- ‘GA-AR’>

http://vswaminathan-swamilook.blogspot.in/2018/05/hear-lawyer-what-he-says-on-lot-of.html

http://vswaminathan-swamilook.blogspot.in/2018/05/gaar-contd.html

http://vswaminathan-swamilook.blogspot.in/2018/05/ga-ar-and-rules.html ;

in the sincere hope and servant expectation of those being of useful guidance !

Apropos of Post of May 24- ‘servant’ to be corrected and read /’subservient’.

With the same expectation,to supplement:

https://www.facebook.com/swaminathanv3/posts/1681376445271968

Read comment on- ‘AAR’ s powers; and the Amendment of Sec 245 N (a)- Insertion of new clause (iv) and of the Proviso (iii) to sec 245 R !

It`s unfortunate that the IT dept. insists on e-assessment even when the hapless assessees object to it. Most of the assessees don`t have the wherewithal of responding to e-submissions. Tax Officers to please their bosses would resort to rash high pitched assessments. YES the cure is WORSE than the disease.

I can remember two nuggets from Dastur Saab which I had the privilege of listening.

While he was arguing in AAR on Indo UAE tax treaty the judges listening to his passionate oratory remarked “ you are generating too much heat Mr. Dastur. He quipped “No sir I am generating light”.

The other was before Mumbai ITAT while he was arguing before a special bench, the VP on the bench said “you argue too much Mr.Dastur”. He politely thanked the bench and said “ my clients are present in court and they would be happy to know that”.

Greatness of the man. I share the above with all my juniors and associates.

I heard Mr. S.E. Dastur in Allahabad High Court where I do law practice as a lawyer. His erudition and mastery of the language coupled with the ease with which he could persuade the Court to appreciate his arguments were remarkable.

Fantastic memory to recall case law with citation to counter adversary’s arguments. Humility personified. Plain living but high thinking.